By USABR.

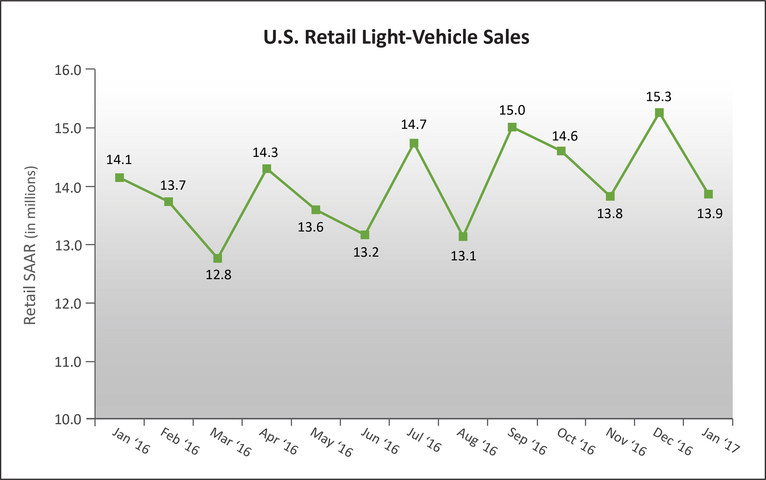

Following a strong close to 2016, January’s retail new-vehicle seasonally adjusted annualized sales rate (SAAR) is expected to slow to 13.9 million units in 2017, down 200,000 units from last year, according to a forecast developed jointly by J.D. Power and LMC Automotive.

U.S new-vehicle retail sales in January are expected to reach 874,400 units, a 2.0% decline compared with January 2016, while total light-vehicle sales are expected to reach 1,125,900 units, a 1.8% decline.

“With sales posting impressive gains at the end of December, the slow start to January was not unexpected,” said Deirdre Borrego, senior vice president of automotive data and analytics at J.D. Power. “While this year will mark the first time that the industry has started off with a retail sales decline since 2010, the retail SAAR remains robust. The challenges for the industry remain maintaining profitability while coping with high inventory levels and elevated incentives, which continue to rise year over year.”

Through the first 10 days of January, incentive spending per unit was $3,614, down $387 from December ($4,001) but up $232 from January 2016 ($3,382).

J.D. Power and LMC Automotive U.S. Sales and SAAR Comparisons |

January 20171 | December 2016 | January 2016 | |

New-Vehicle Retail Sales | 874,400 units (-2.0% lower than January 2016) | 1,392,522 units | 892,119 units |

Total Vehicle Sales | 1,125,900 units (-1.8% lower than January 2016) | 1,687,154 units | 1,146,483 units |

Retail SAAR | 13.9 million units | 15.3 million units | 14.1 million units |

Total SAAR | 17.3 million units | 18.4 million units | 17.6 million units |

1Figures cited for January 2016 are forecasted based on the first 16 selling days of the month. |

- Fleet sales are expected to total 251,600 units in January, down 1.1% from January 2016. Fleet volume is expected to account for 22% of total light-vehicle sales, the same level as in January 2016.

- The average new-vehicle retail transaction price to date in January is $31,473, a record for the month, and surpassing the previous high of $30,826 set in January 2016.

- With record transaction prices for the month offsetting slightly lower absolute retail sales volumes, consumers are on pace to spend $27.5 billion on new vehicles in January, on par with last year’s level but slightly behind the record high of $28.3 billion set in January 2015.

- Trucks account for 63.3% of new-vehicle retail sales so far in January—the highest level ever for the month of January. However, truck sales mix is down slightly from December’s all-time record level of 64.4%.

Jeff Schuster, senior vice president of forecasting at LMC Automotive, said: “After an overheated close to 2016 and the increased likelihood of deregulation and fiscal stimulus from the Trump administration driving the economy higher, we now expect 2017 to be another record year in U.S. auto sales, though there is a lot of runway before the year is complete. While there are many variables to consider this year, one area of caution is the large number of lease maturities repopulating the used-car market. It creates demand for a vehicle, but also more used-vehicle options to compete with the new-vehicle market.”

LMC is forecasting total light-vehicle sales in 2017 to be at 17.6 million units, an increase of just 0.1% from 2016. Retail light-vehicle sales are expected to reach 14.1 million units in 2017, essentially flat from 2016.