The blockchain technology has taken a serious position and advantage ahead of the current old and expensive payment systems.

Bitcoin is the largest blockchain with the market capitalization $ 91 billion. This article will review and introduce some of the factors that drive the Bitcoin price up.

Bitcoin has already split two times. The first split took place on 1st August. The new currency was called Bitcoin cash (BCH).

The second split took place on 24th of August and the new currency was called Bitcoin gold (BTG).

Every single split of the original Bitcoin is affecting the market capitalization of Bitcoin. However, we have observed similar behavior with the all of the splits.

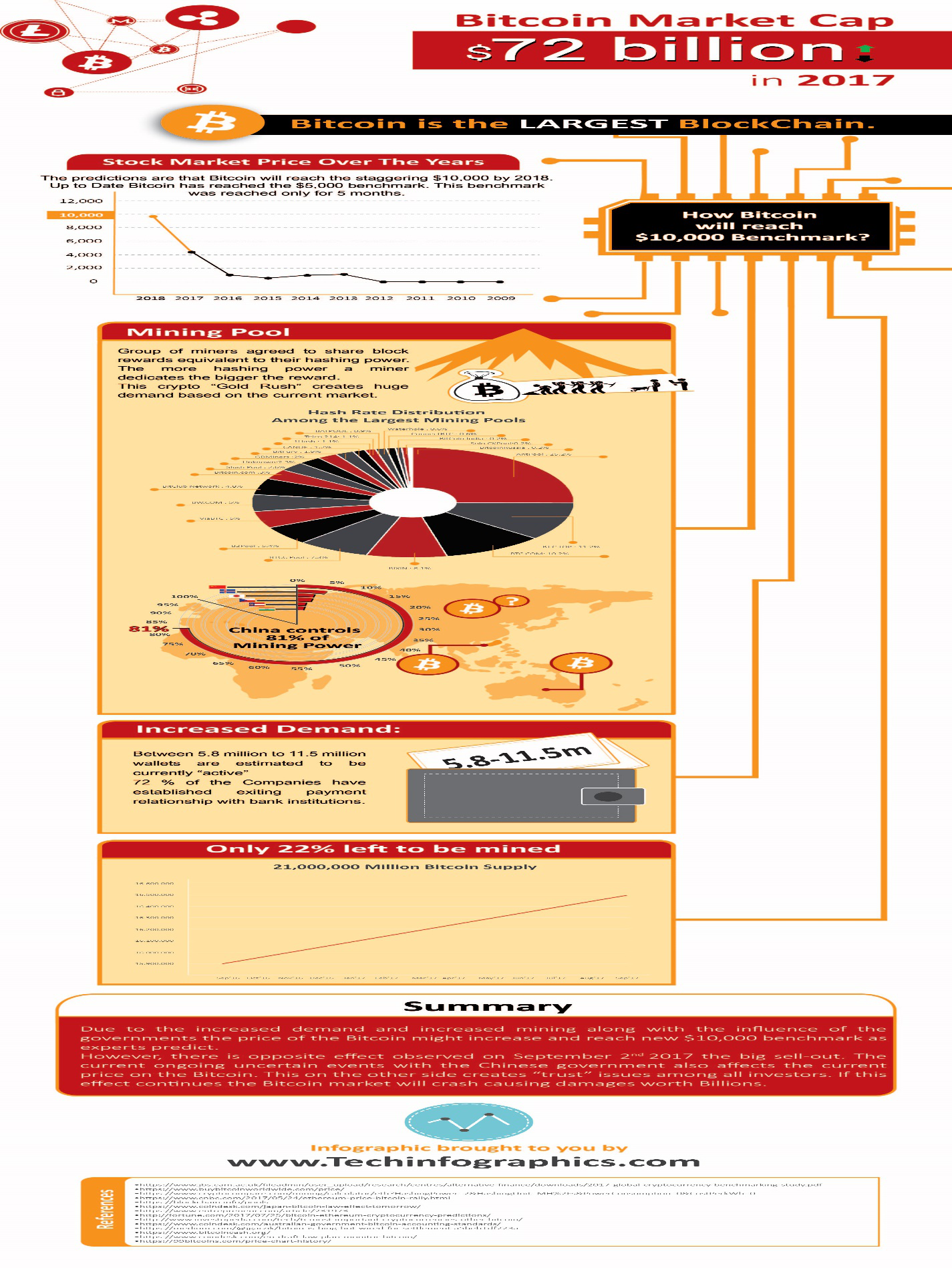

Mining Bitcoin Affects the Bitcoin Price The digital mining is a huge business. Many investors, individuals and even countries undertake the Bitcoin mining. The infographic reveals how the mining process works. It also shows that mining itself takes huge contribution into the Bitcoin price.

Currently, the difficulty has increased a lot for the past few years. In order to mine Bitcoin, you would need huge upfront investment and be prepared to pay large electricity bills.

Increased Demand for Bitcoin

The increased demand for Bitcoin leads the digital currency to flourish and continue to outperform any other available fiat and digitalcurrencies.

Bitcoin price is heavily driven by the demand. If there were no demand, there would benothing.

Many investors along with the miners hold a huge amount of Bitcoin supply. This creates price bubble causing the digital currency to grow in marketcapitalization.

Bitcoin price could be damaged by even one single “tweet” on twitter. This behavior alone reveals how unpredictable and out of control the digital currency is. For example, if the Bitcoin market is hit by any kind of uncertainty concerning the investors, this might trigger them to dump all of their Bitcoin supply on the market causing the price to drop and the market tocrash.

The Bitcoin Supply

Bitcoin is fast approaching the 78% of its original fixed supply. The fixed supply combined with that how much actually is left out there is pushing the price up and it is one of the main factors.

Experts believe that Bitcoin will soon reach new unseen $10,000 benchmark. The supply plays a very important role into everything. A limited supply of something with high demand means only high price.

As you can see in the infographic. This infographic is clearly attempting to make an aggressive prediction of how exactly Bitcoin will reach the $10,000 benchmark.

I personally advise anyone who is willing to invest their money into Bitcoin to do their own research on the concerning topic.

My personal opinion is that Bitcoin will hit $10,000 by the end of next year. However, this only my own opinion.

(Infographic by Techinfographics: bitcoinprice)

Author Bio:

Dimitar Dimitrov, the owner, and PM of Techinfographics.com. Dimitar is a young entrepreneur who is into technology and innovation. He is an investor and key figure into several other online projects. He travels and writes about technology and business.